Award-winning PDF software

How to prepare Schedule C 2019

About Schedule C 2019

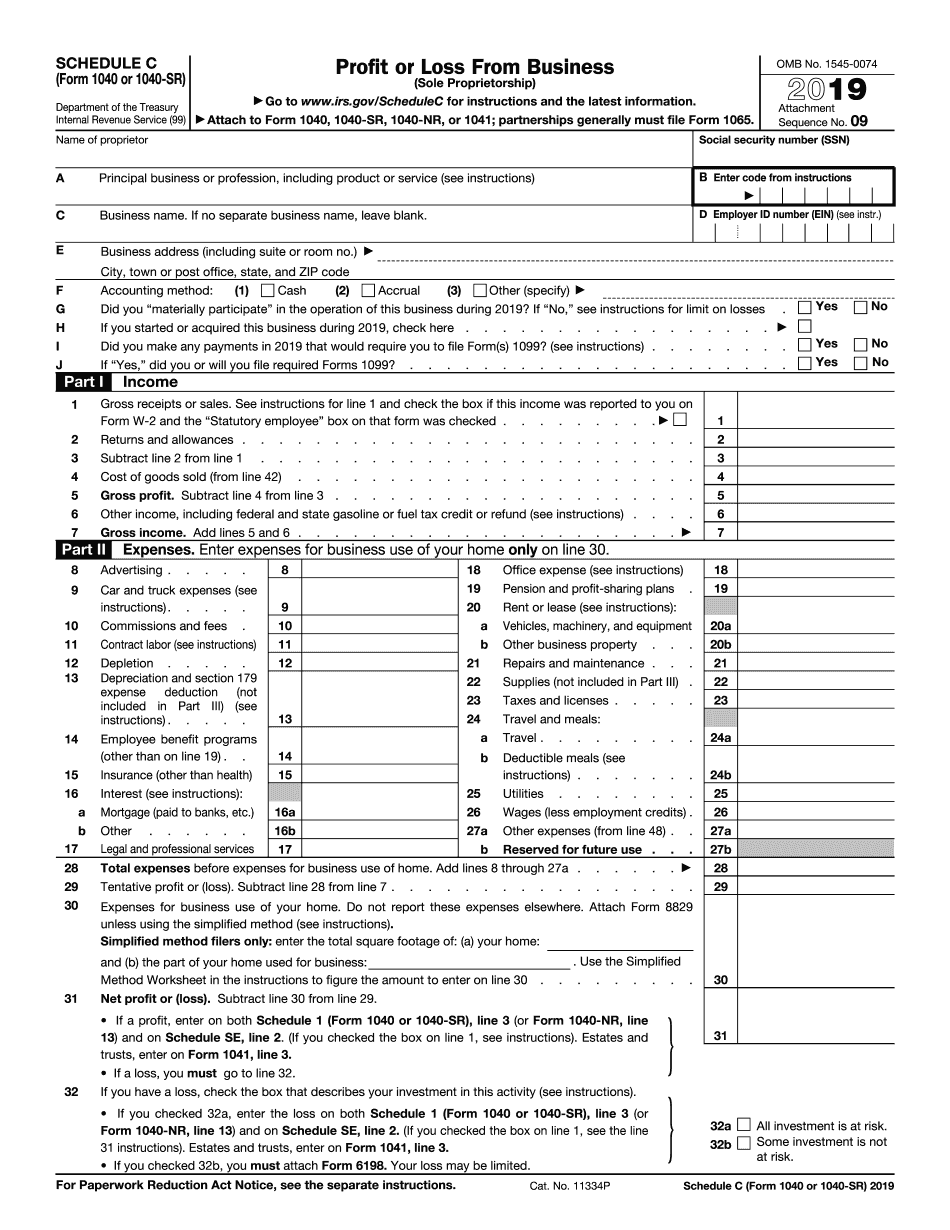

Schedule C is a tax form used by self-employed individuals or sole proprietors to report their business income and expenses for a specific tax year. It is a supplemental form that accompanies the individual's Form 1040, which is the main tax return form used to report personal income. If you are self-employed and operate a business as a sole proprietor, you will likely need to file Schedule C along with your personal tax return. This includes individuals who earn income through freelance work, independent contracting, consulting, running a small business, or any other self-employed venture. Schedule C allows you to report your business income, deduct allowable business expenses, calculate your net profit or loss, and determine the amount of self-employment taxes owed (which includes both the employer and employee share of Social Security and Medicare taxes). Additionally, certain individuals who own a single-member LLC (Limited Liability Company) and choose to file taxes as a sole proprietorship would also use Schedule C to report their business income and expenses. However, if the LLC has elected to be taxed as a corporation, then Schedule C would not be applicable.

Get Schedule C 2025 and simplify your everyday file administration

- Locate Schedule C 2019 and begin editing it by simply clicking Get Form.

- Begin filling out your form and include the data it needs.

- Benefit from our extensive editing toolset that lets you add notes and make comments, if needed.

- Take a look at form and check if the details you filled in is right.

- Quickly fix any error you have when modifying your form or go back to the prior version of your document.

- eSign your form effortlessly by drawing, typing, or taking a photo of your signature.

- Save changes by clicking Done and after that download or send your form.

- Submit your form by email, link-to-fill, fax, or print it.

- Select Notarize to do this task on your form online using our eNotary, if necessary.

- Safely store your complete papers on your computer.

Editing Schedule C 2025 is an easy and user-friendly process that needs no prior training. Get all you need in a single editor without the need of constantly switching in between different platforms. Locate much more forms, fill out and preserve them in the format that you need, and streamline your document administration within a click. Before submitting or delivering your form, double-check details you filled in and easily fix mistakes if necessary. If you have questions, contact our Support Team to assist you.